M&A & Post-Merger Integration

LoyaltyOps™ Installs The Organizational Performance System That Aligns Leaders, Stabilizes Teams, And Creates Reliable Execution During Mergers And Acquisitions

When Two Organizations Operate Differently, Performance Breaks Down

The Real Integration Risk Is Behavioral, Not Structural.

Most mergers fail not because of strategy, financials, or synergies. But because people think, behave, and decide differently.

Leadership teams reinforce expectations inconsistently. Managers adopt conflicting standards. Teams operate with different habits and assumptions.

Without a shared behavioral system, integration becomes slow, reactive, and unpredictable.

The Performance Challenges Undermining M&A Success

The Hidden People Gaps Causing Friction And Performance Challenges In M&A Integration

Leadership teams modeling different expectations

Misaligned communication across legacy organizations

Conflicting decision patterns slowing execution

Silos forming between “legacy A” and “legacy B”

Managers reinforcing standards unevenly

Variability in performance across teams and sites

Difficulty merging processes and workflows

Cultural tension reducing trust and collaboration

Clients experiencing inconsistent delivery during transition

These challenges show one thing: integration requires aligned behavior, and you’re ready for the system that makes that possible.

How We Improve M&A Integration Performance

We Align Leadership Behavior, Unify Team Execution, And Create One Consistent Way of Working

LoyaltyOps™ installs the Organizational Performance System across merging companies so leaders, managers, and teams operate from the same behavioral standards.

This creates one unified way of communicating, deciding, and executing: the foundation of any successful integration.

Who We Serve in M&A / PMI

Alignment Across the Roles, Structures, and Layers That Determine Integration Success

We work with organizations navigating mergers, acquisitions, roll-ups, expansions, and post-merger integrations. Environments where reliable performance and unified behavior determine the success of the transaction.

Types Of Organizations We Support

Private Equity Firms Bringing In New Portfolio Companies

Founder-Led Companies Joining A Larger Entity

Roll-Up Strategies Consolidating Multiple Businesses

Organizations Experiencing Culture Clash Or Operational Friction

Teams Merging After Acquisition Or Strategic Partnership

Industries We Support With M&A & Integration Services

Organizations Across Sectors Benefit When Leadership Behavior and Team Execution Stay Consistent Through Integration

We support integrations across industries where execution, coordination, and clarity matter most.

Private Equity & Portfolio Companies

Mergers create leadership and execution inconsistencies across portfolio teams. We unify leadership behavior and team execution so integrations move faster and deliver predictable results.

Professional Services Firms

Legacy partnerships and practice groups struggle to operate as one firm post-merger. We align partner behavior and team collaboration so client delivery becomes consistent across the merged entity.

Creative & Digital Agencies

Different creative philosophies and workflows clash during agency integrations. We standardize expectations and collaboration habits so teams deliver faster with fewer revisions.

Financial Services & Advisory Groups

Risk, compliance, and advisory teams often operate from conflicting standards after a merger. We align decision-making and communication so service quality remains consistent for clients.

Manufacturing & Operational Organizations

Plants and sites operate with different norms after consolidation. We create unified leadership and execution behavior so throughput, quality, and safety become consistent across facilities.

Healthcare & Health Services

Clinical and administrative teams struggle to blend processes and expectations. We align behavior across units so patient experience stays reliable through integration.

SaaS & Technology Companies

Merging product, engineering, and GTM teams often leads to friction and misaligned priorities. We unify team behavior and decision patterns so roadmaps, releases, and customer delivery stay coordinated.

Nonprofit Organizations

Mission and culture differences cause confusion when nonprofits merge or consolidate. We establish clear leadership and team habits so programs deliver consistently across merged organizations.

Public Sector & Government Services

Mergers create confusion across departments with entrenched habits. We align leaders and departments so public service remains clear, coordinated, and reliable.

Retail / Multi-Site

Customer experience varies across legacy locations after acquisition. We unify behavioral standards so every location delivers a consistent brand experience.

Construction, Logistics & Field Services

Project teams and field crews operate differently after consolidation. We align communication and accountability so project delivery becomes predictable across teams.

Franchises

Franchise owners, managers, and teams often operate differently across locations. We align leadership behavior and team expectations so every unit delivers the same consistent performance and brand experience.

We Help Organizations Integrate Faster, Cleaner, and With Greater Confidence

LoyaltyOps™ Installs The Organizational Performance System That Unifies Behavior, Strengthens Coordination, And Reduces Friction in M&A

Schedule a discovery call to explore how we align leaders, stabilize teams, and create predictable execution during M&A.

The ROI of Behavioral Alignment in M&A

Consistent Behavior Creates Reliable Execution — Which Drives Integration Success

Organizations that install our performance system see gains across:

Faster integration timelines

Reduced conflict between legacy teams

Clearer decision ownership

More predictable performance metrics

Lower leadership dependency

Fewer operational disruptions

Better client retention post-merger

Lower cultural and behavioral risk for investors

The Organizational Performance System reduces friction, stabilizes execution, and improves outcomes during mergers and acquisitions.

Solutions That Strengthen Integration Performance

High-Impact Performance Systems That Create Alignment Across Legacy Organizations

Leadership Performance Development

Strengthen how leaders think, behave, and decide so teams follow one aligned standard post-integration.

Founder Leadership Advisory

Support founder transitions by building the behavioral structure needed for scalable leadership inside a merged organization.

Executive Alignment & Organizational Performance

Unify leadership teams from both entities so decisions, modeling, and communication become consistent and predictable.

AI & Tech Transformation

Prepare merged teams to adopt shared platforms, tools, and workflows with aligned execution and reliable coordination.

Culture & Trust Alignment

Correct conflicting norms, expectations, and communication styles so new teams trust and operate effectively together.

Customer Experience

Align internal behavior with external delivery so clients experience stability and reliability throughout the integration period.

What Sets Us Apart in M&A Integration

A Systemic Approach Competitors Don’t Offer

Most integration efforts focus on org structure, operations, or process mapping. But execution only becomes reliable when people operate the same way. LoyaltyOps™ aligns leadership behavior, decision patterns, and communication standards so two organizations become one, quickly and cleanly.

Integration Playbooks & Consultants

They map workflows, not behavior.

We align how people think, behave, and decide: the root of successful integration.

HR, Culture & Engagement Programs

They measure sentiment, not execution.

We fix the behavior gaps causing conflict and confusion post-merger.

Training, Workshops & Offsites

They create short-term enthusiasm but not lasting alignment.

We install systems that make unified execution the daily norm.

Strategic Advisors & PE Operating Partners

They diagnose issues, but don’t change how people operate together.

We transform behavior so integration becomes predictable, not painful.

This is why organizations preparing for M&A integration choose LoyaltyOps™ when reliable execution and scalable performance matter.

When Behavior Aligns, Integration Happens Faster, Cleaner, And With Better Performance

Results Organizations Achieve During M&A with LoyaltyOps™

Organizations see faster integration, more stable teams, and more consistent execution when leaders model unified standards and teams follow shared behaviors.

Leadership

Aligned modeling, clearer communication, and predictable decisions across legacy entities.

People

Higher ownership, fewer conflicts, and smoother cross-functional execution.

Clients

More consistent service, stronger trust, and stable delivery despite internal change.

Brand

Reduced integration risk, increased operational stability, and faster path to performance.

What Unified Behavior Makes Possible After a Merger

When Leaders and Teams Operate the Same Way, Two Organizations Become One High-Performing Company

When leaders model the same expectations and teams follow a shared behavioral system, integration no longer feels fragmented or reactive.

Communication becomes smoother, decisions become faster, and teams collaborate without the legacy tensions that typically slow mergers down.

The organization gains stability, clarity, and momentum, making the integration not just complete, but genuinely successful.

Strengthen Performance Across Your Organization During M&A

Start With a Discovery Call

1. Book a

Discovery Calll

We start by understanding your goals, challenges, and what is getting in the way of consistent performance.

2. Install the LoyaltyOps™ System

We align your people, process, and performance through a structured implementation that creates clarity and consistency.

3. Scale with Confidence

You gain a team that communicates clearly, executes predictably, and scales at the speed your strategy and technology require.

Ready to get started?

Recommended Insights

Recommended Insights on M&A and Post-Merger Integration

Why Leaders Are the Cause of Meeting Bloat

Meeting bloat is not a scheduling problem. It is a leadership problem. Learn why ineffective meetings originate at the top, how leaders unintentionally create meeting overload, and what standards are ... ...more

People — Leadership, Culture & Behaviour

December 08, 2025•5 min read

The Meeting Standards Every High-Performing Team Needs

Most meetings fail before they start. Use this Meeting Standards Checklist to reduce meeting waste, improve clarity, and install the leadership habits that create high-performing teams. Learn the prep... ...more

Process — Systems, Structure & Execution

December 08, 2025•5 min read

The Most Expensive Part of Your Business Might Be Your Meetings

Meetings are one of the most expensive activities inside any organization. The real issue is not the meeting itself. It is the lack of preparation before it. Learn how leaders can reduce meeting waste... ...more

People — Leadership, Culture & Behaviour

December 08, 2025•5 min read

Contact Us

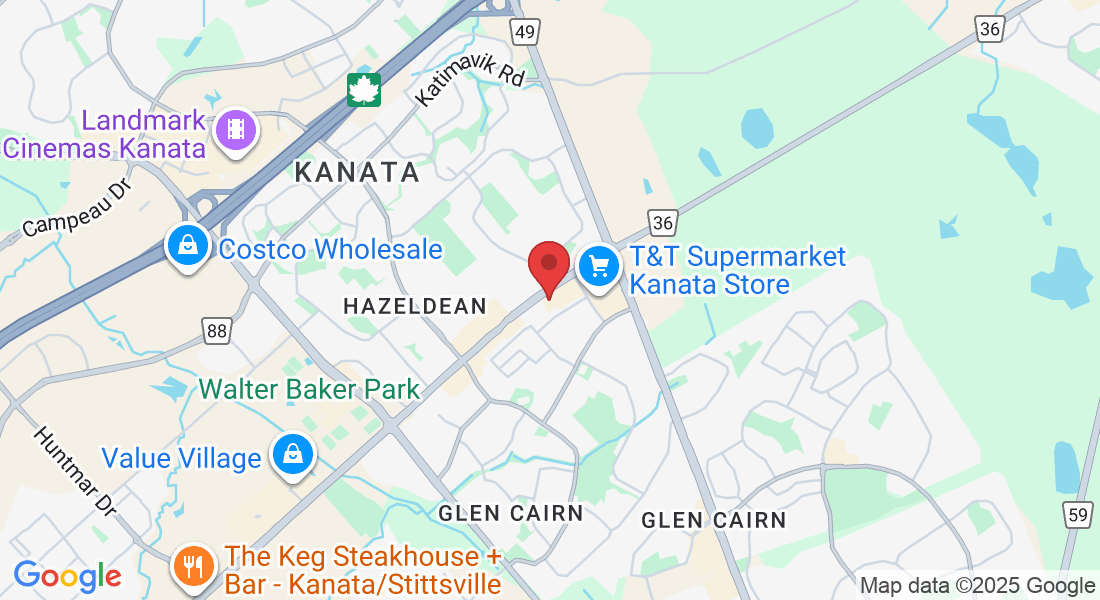

LoyaltyOps™ HQ

430 Hazeldean Road,

Unit #6, Suite 17

Kanata, Ontario, Canada

K2L 1T9

Email: [email protected]

Phone: 1 365-659-4720

Facebook

LinkedIn