Financial Services & Advisory Groups

We Help Leaders Build A High-Performance Advisory Organization

Financial Services Organizations Operate Under Massive Pressure

Regulatory complexity, risk management, market volatility, client expectations, and cross-functional coordination.

As teams grow and responsibilities evolve, leaders, managers, and departments begin to think, behave, and decide differently, creating performance drift that slows execution, increases risk, and undermines client trust.

How LoyaltyOps Improves Performance In The Financial Services Sector

Aligned Leadership Behavior, Team Execution, And Client Delivery

LoyaltyOps helps financial services organizations through a structured installation, aligning leadership behavior, decision patterns, team execution, and client-facing performance. This ensures communication, ownership, and delivery follow one consistent standard across channels, roles, and departments.

What We Strengthen:

Behavioral alignment across departments

Decision consistency in high-stakes environments

Manager accountability and expectations

Team execution rhythms and role clarity

Cross-functional coordination across risk, compliance, and operations

Client-facing reliability and communication

Strengthen Performance In Your Financial Services Organization

LoyaltyOps™ Aligns Leadership, Stabilizes Execution, And Improves Reliability Across Financial Teams

Schedule a discovery call to explore how we strengthen leadership behavior, improve team performance, and install the systems that make execution consistent across client-facing, operational, and risk-driven teams.

The ROI Of Performance Alignment In The Financial Services Sector

Consistent Behavior Creates Reliable Execution — Which Drives Measurable Results

Reduce friction, stabilize execution, and protect profitability in high-pressure financial environments.

Faster decision cycles across leadership

Reduced rework and operational friction

Lower escalation load and clearer ownership

More consistent client service and communication

Improved margin and operational stability

Reduced errors and compliance issues

Better collaboration across risk, compliance, and operations

What Makes LoyaltyOps Different In The Financial Services Sector

A Systemic Approach Competitors Don’t Offer

Most solutions in the financial sector focus on tools, compliance frameworks, training, or advisory recommendations. LoyaltyOps™ aligns leaders, managers, and teams, something no traditional consulting, training, or technology firm provides.

Traditional Operating Frameworks

They define structure but not behavior.

You need to align how leaders and teams think, behave, and decide so execution becomes reliable.

HR, Surveys, And Engagement Platforms

They measure sentiment, not execution.

You need to correct the behavior patterns that create drift and risk.

Consulting Firms & Advisors

They create insight, not sustained behavioral change.

You need a daily performance system people follow long-term.

Offsites, Training, And Team Building

They diagnose issues but do not change how teams operate under pressure.

You need to transform behavior, execution, and decision patterns directly.

This is why financial service and advisory groups choose LoyaltyOps™ when reliable execution and scalable performance matter.

Results Financial Services Organizations Achieve With LoyaltyOps™

When Behavior Aligns, Performance Improves, Consistently And Measurably

Financial services teams operate with more confidence when leaders model clear standards and teams follow aligned behavioral expectations.

Decision cycles shorten, cross-department friction decreases, and client communication becomes more consistent and reliable, all critical in regulated, high-stakes environments.

Start With a Conversation

3 Easy Steps To Get Started

1. Book a

Discovery Calll

Start with a conversation to understand where performance is breaking down today, and whether LoyaltyOps is the right fit.

2. Build a Team That Wins

Leaders work through a structured process to define clear standards and design the environment that makes high performance the default.

3. Win Again and Again

Teams operate with confidence and momentum. Decisions move forward, commitments hold, and winning becomes repeatable as the business grows.

Ready to get started?

Recommended Insights

Resources to Support Financial Services & Advisory Groups

From Chaos to Consistency: The Discipline Behind High-Performing Teams

High-performing teams are built through disciplined leadership, cultural clarity, and aligned systems. Learn how to move from chaos to consistency inside growing organizations. ...more

Leadership & Behaviour

February 19, 2026•6 min read

How Overfunctioning Becomes a Career Trap for Women Entrepreneurs and CEOs

Overfunctioning often looks like leadership but creates bottlenecks and burnout. Learn how women CEOs replace overextension with clarity and disciplined execution. ...more

People — Leadership, Culture & Behaviour

February 19, 2026•4 min read

The Hidden Cost of Lack of Clarity at Work for High-Performing Women

High-performing women often burn out in unclear systems. Learn how ambiguity drives overfunctioning, hurts confidence, and how leaders can restore clarity. ...more

People — Leadership, Culture & Behaviour

February 19, 2026•5 min read

Contact Us

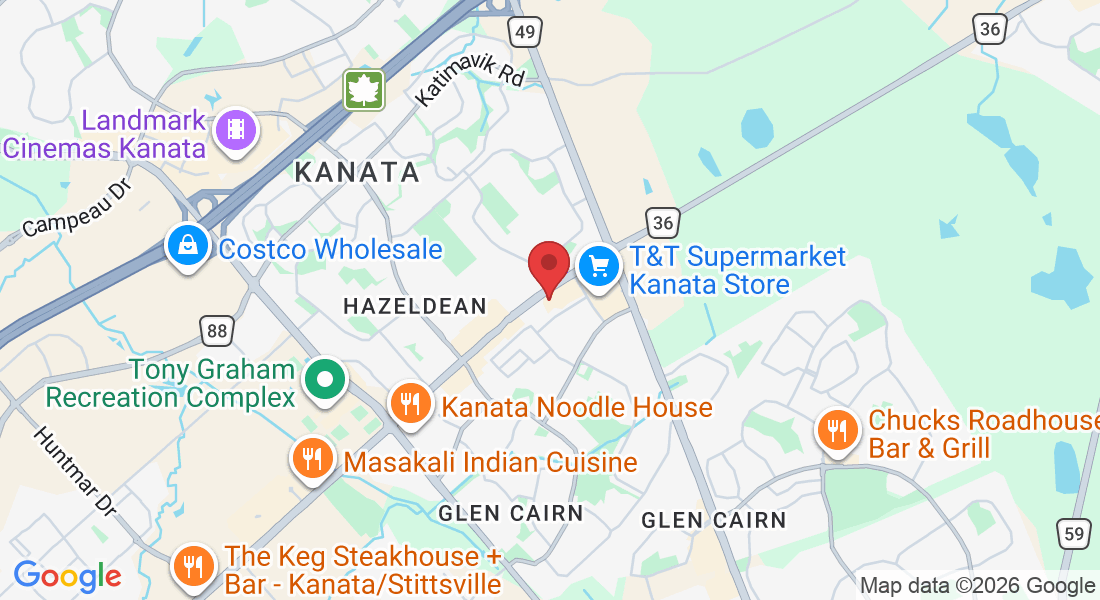

LoyaltyOps™ HQ

430 Hazeldean Road,

Unit #6, Suite 17

Kanata, Ontario, Canada

K2L 1T9

Email: [email protected]

Phone: 1 365-659-4720

Facebook

LinkedIn